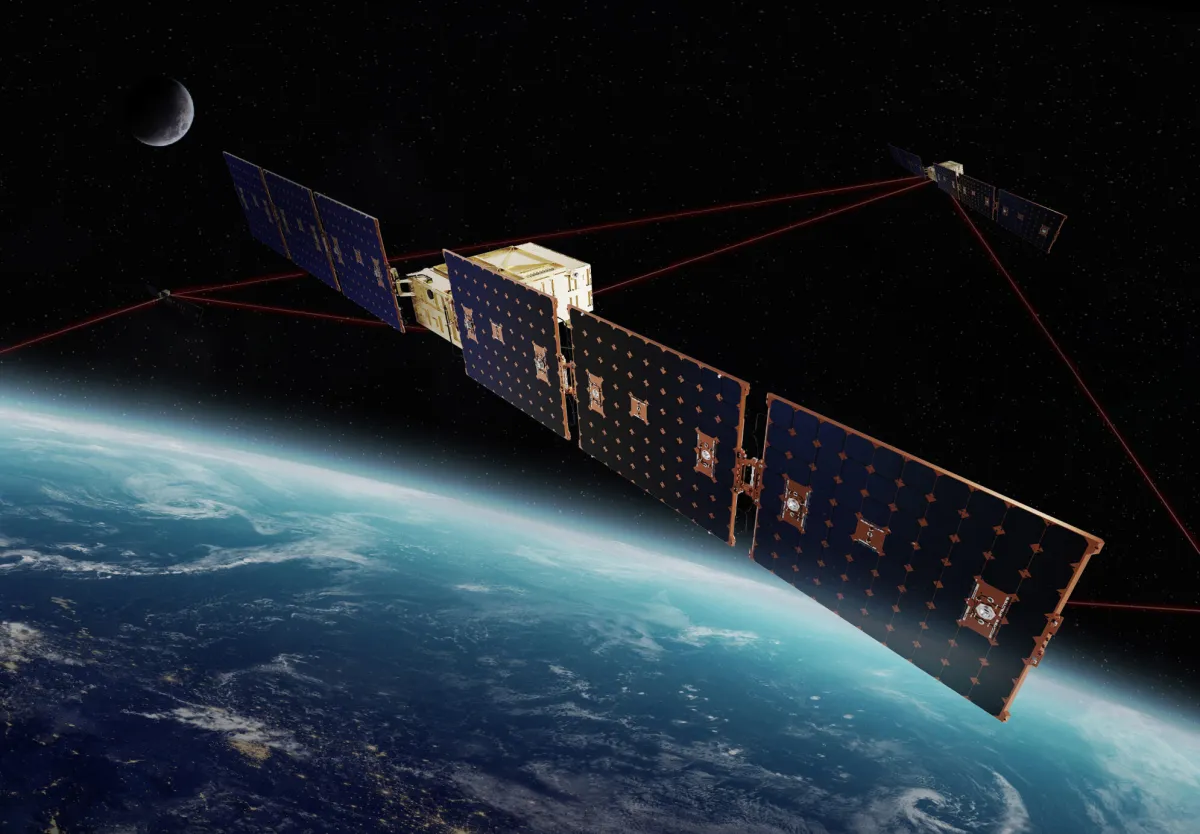

Terran Orbital, a leading satellite manufacturer, has announced a significant deal with Lockheed Martin just ahead of its earnings call. The agreement entails Lockheed Martin purchasing 18 satellite buses from Terran Orbital, which will be utilized for the production of 18 satellites for the Space Development Agency’s Tranche 2 Tracking Layer contract.

The timing of this announcement, strategically placed before the earnings call, suggests an effort by Terran Orbital to reassure investors about the strength of its partnership with Lockheed Martin. This move comes shortly after Lockheed Martin withdrew its offer to acquire Terran Orbital, a move that caused a sharp decline in the company’s stock price.

Strengthening Partnerships

Terran Orbital’s CEO, Marc Bell, expressed pride in being selected once again as Lockheed Martin’s space vehicle provider, especially for the critical tracking mission of the Space Development Agency. This continued partnership underscores the confidence Lockheed Martin has in Terran Orbital‘s capabilities.

Significant Milestones Achieved

The latest agreement brings the total number of satellite buses ordered by Lockheed Martin to 106, further solidifying the partnership between the two companies. Lockheed Martin’s satellite orders account for a significant portion of Terran Orbital’s backlog, indicating the importance of this collaboration for both parties.

Despite these positive developments, Terran Orbital has faced challenges, particularly regarding its contract with Rivada Space Networks. Delays and uncertainties surrounding this contract have led to speculation about Terran Orbital’s financial stability. However, as long as the company’s stock price remains above $1, it will not face the risk of delisting from the NYSE.

While Terran Orbital navigates through a turbulent period, its latest agreement with Lockheed Martin demonstrates its resilience and commitment to advancing in the satellite industry. Investors eagerly await the upcoming earnings call for further insights into the company’s financial performance and strategic outlook.