A Viksit Bharat @2047: Progressing with the world, rooted in values, driven by vision (Representational Image Only)

Executive Highlights

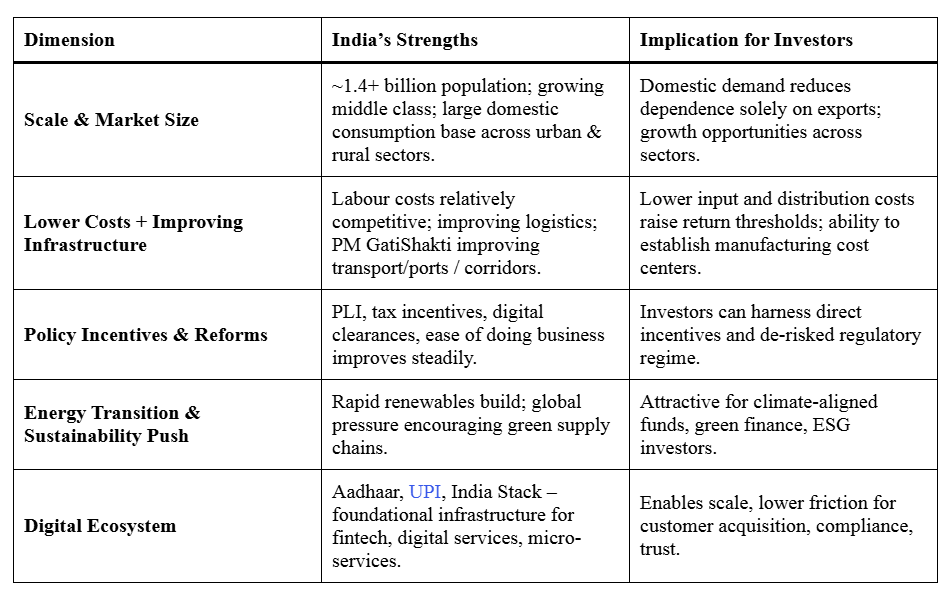

- India’s economy is growing strongly, backed by a large population, improving policy environment, and reforms. Recent government programmes (such as the Production-Linked Incentive (PLI) scheme, PM GatiShakti, digital public infrastructure) are making India more business-friendly, lowering risk, and attracting capital.

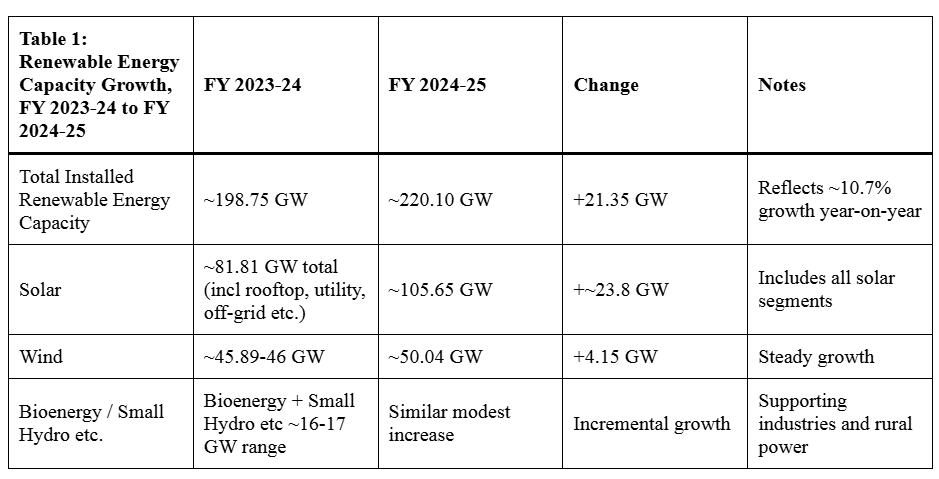

- In FY 2024-25, India added ~29.52 GW of renewable energy capacity, bringing total installed renewable energy to ~220.10 GW. Solar energy addition was ~23.83 GW, wind ~4.15 GW, with bioenergy and small hydro also making contributions.

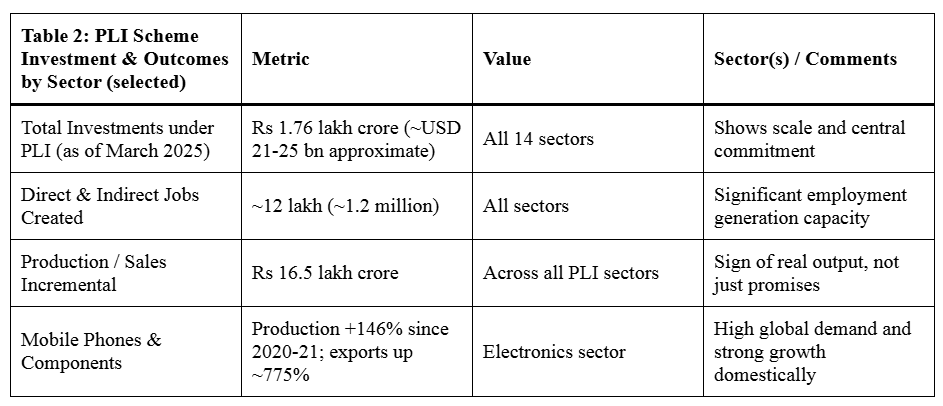

- The PLI schemes have attracted ₹1.76 lakh crore (~USD 21-25 billion) in investments, generated over 12 lakh jobs, and produced incremental sales of ~₹16.5 lakh crore across 14 strategic sectors.

- India is making progress toward its climate commitments: non-fossil fuel based capacity (renewables + hydro + nuclear) is rising quickly, helping to push toward the target of 500 GW non-fossil capacity by 2030.

- Strong policy levers are active: integrated infrastructure planning (PM GatiShakti), improved regulatory clarity, incentives, digital approvals, and reforms in labour, land and environmental approval processes.

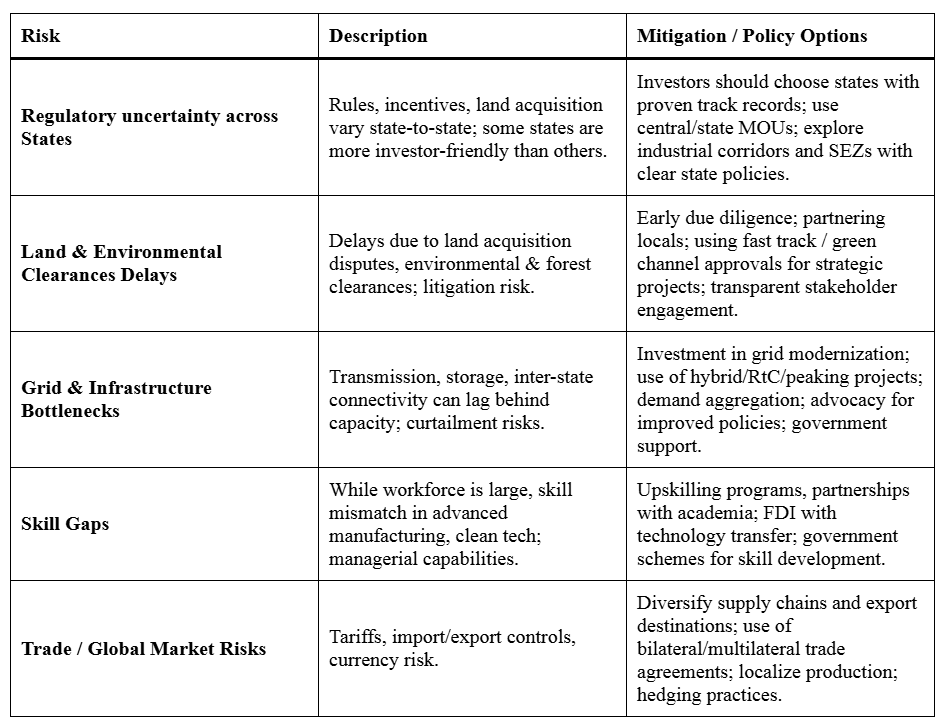

- Key risk areas (e.g. regulatory heterogeneity among states, delays in land/environment clearances, grid/infrastructure bottlenecks) exist, but mitigation pathways are visible and improving.

Introduction: Global and National Context

India is increasingly viewed internationally as an essential pillar for global growth, climate action, supply chain diversification, and strategic investment. Global investors and institutions are considering three major vectors:

- Scale of Market & Demographics: With a population exceeding 1.4 billion and rising middle income, domestic demand across consumer goods, services, digital, health, education is growing rapidly.

- Strategic Rebalance: Rising geopolitical and supply chain risk globally has prompted companies to diversify away from single-source dependence. India offers an alternative that combines cost, improving infrastructure, and stable policy.

- Climate & Sustainability Imperative: The global mandate to reduce carbon emissions aligns with India’s targets under its Nationally Determined Contributions (NDCs) and its Panchamrit goals. India’s push for non-fossil energy, net zero by 2070, and associated policies creates investment demand in renewables, storage, green hydrogen, sustainable agriculture etc.

This article provides evidence of India’s recent performance, key reforms, priority sectors, risk & mitigation, and specific recommendations for investors.

Viksit Bharat@2047: Key Recent Performance & Policy Strengths

Renewable Energy & Energy Transition

- Capacity Additions in FY 2024-25: India added ~29.52 GW of renewable energy capacity, taking cumulative installed renewable capacity to ~220.10 GW from ~198.75 GW in the previous year.

- Solar energy added ~23.83 GW, pushing total solar to ~105.65 GW.

- Wind added ~4.15 GW, total ~50.04 GW.

- Bioenergy, small hydro and off-grid systems also contribute meaningfully.

- Pipeline & Targets: India has committed to reach 500 GW of non-fossil fuel capacity by 2030. The number of renewable projects under implementation and tendering is high, indicating strong future growth.

Production-Linked Incentive (PLI) & Manufacturing Upsurge

- The PLI schemes (14 strategic sectors) have drawn investments of ₹1.76 lakh crore by March 2025, created over 12 lakh jobs and generated incremental production/sales of ₹16.5 lakh crore.

- Sectors showing strong results include electronics, pharmaceuticals & bulk drugs, mobile phones & components, food processing, textiles, specialty steel, and solar module manufacturing. For example:

- Mobile phone production growth of 146% since 2020-21; exports up by ~775%.

- Pharma PLI has reversed trade deficits in specific drug components.

Infrastructure & Logistics Reforms

- PM GatiShakti (National Master Plan for Multi-modal Connectivity) is aligning infrastructure investment across transport, logistics, waterways, industrial corridors to reduce cost of logistics, reduce delays and improve predictability for investors. (While specific quantitative data are less recent in public domain for some elements, the policy has wide acknowledgement and application.)

- Single window clearance systems, digital approvals, environmental fast-tracking for strategic investment zones are increasingly available.

Digital Public Infrastructure (DPI)

- India’s Aadhaar, UPI, India Stack (including digital identity, digital payments, unified platforms) provide a cost-efficient, scalable infrastructure for consumer and enterprise services.

- UPI volumes continue to rise (billions of transactions), enabling fintechs, e-commerce, digital services to scale fast, reduce costs of customer acquisition, de-risk payments and KYC. (Recent official reporting confirms exponential growth, though precise latest numbers must be drawn from government data.)

Human Capital & Policy Predictability

- India has a young workforce; median age around late 20s to early 30s. Skill development, vocational training, higher education reforms, and schemes to connect academia and industry are being scaled.

- Policy documents (e.g. NITI Aayog’s “Strategy for New India”, annual reports, 5-year investment plans) have laid out long-term vision (e.g. the goal of USD 5-trillion economy). Investors benefit from this policy horizon.

Comparative Advantages: Why India Outperforms (Viksit Bharat@2047)

Viksit Bharat@2047: Priority Sectors for Global Investment

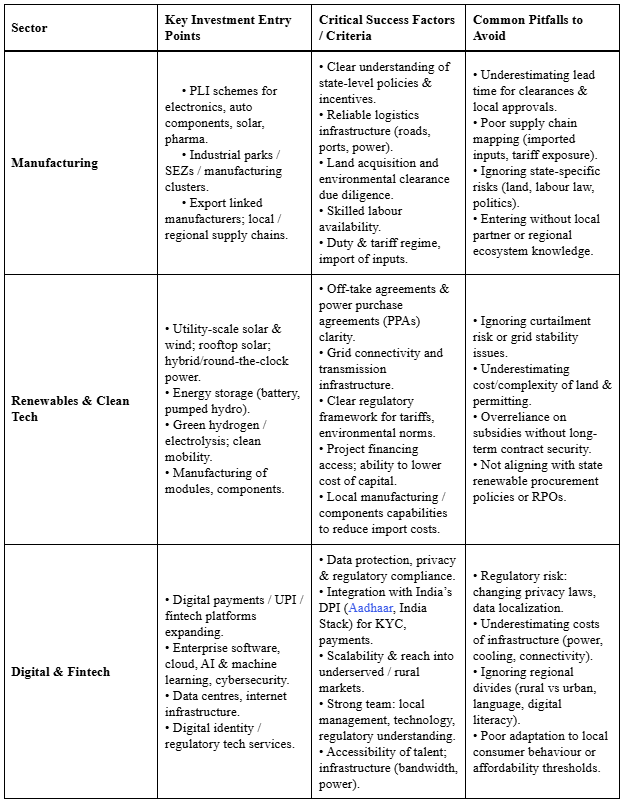

Based on India’s policy priorities, sectoral capacity, export potential, and global demand, following sectors stand out:

- Manufacturing

• Electronics, mobile & components; solar module & panel manufacturing; auto components & EV supply chain; pharmaceuticals & biotechnology; white goods.

• PLI scheme makes many opportunities in these sectors financially attractive. - Renewables & Clean Tech

• Utility-scale solar & wind; rooftop solar; hybrid / round-the-clock renewables and peaking/dispatchable power; energy storage (battery, pumped hydro); green hydrogen; clean mobility. - Digital & Fintech

• Digital payments, financial inclusion, insur-tech, regulatory technology; enterprise SaaS; cloud computing & data centres; AI/ML; internet infrastructure; digital identity, cybersecurity. - Agritech, Food Processing & Logistics

• Cold-chain, agro-processing zones, export value chains; farm-to-market connectivity; smart agriculture technologies. - Health & Education Tech

• Telemedicine, medical devices; edtech, upskilling, vocational training with digital tools.

Viksit Bharat@2047: Risk Factors & Mitigation Strategies

Recommendations (Viksit Bharat@2047): What India & Partners Should Do Next

- Enhance Certainty in Policy Implementation. Clear timelines, predictable regulatory regime, binding agreements, and state coordination.

- Boost Financial Instruments. Expand blended finance, guarantees, green bonds, risk-sharing mechanisms for first movers in emerging technologies (green hydrogen, storage, etc.).

- Accelerate Infrastructure Deployment. Prioritize grid strength, power evacuation, transmission lines, ports, roads, industrial parks.

- Scale Skill Development. Focus on manufacturing and clean tech skills, digital skills; strengthen vocational training, apprenticeships.

- Facilitate Land & Environmental Clearances. Clear guidelines, faster processing, enhanced transparency.

- Promote Domestic Value Chains. Link PLI and other incentives to deepening value addition, R&D, localisation of inputs.

- Engage with Global Investors with ESG / Impact Focus. India’s sustainability goals are aligned with global climate finance; develop frameworks to attract ESG funds, ensure environment/social governance standards.

Case Examples (Illustrative)

- Electronics & Mobile Phones: Under PLI, mobile phone production has grown 146% since FY 2020-21; exports have surged ~775% to FY 2024-25. Local supply chains for components and contract manufacturers are expanding rapidly.

- Solar & Renewables: Solar capacity crossed 100 GW, wind 50+ GW; strong pipeline of new renewable & hybrid projects; global demand for solar panels & green power gives dual opportunity (domestic supply and export).

Annexed Data Tables

Below are data tables summarizing key energy, investment, job-creation metrics, useful for reference.

One-Page Investor Checklist: Manufacturing, Renewables & Digital

Below is a practical checklist for investors — for due diligence, alignment, and maximizing return — tailored by sector.

Investor Checklist

Conclusion: Why the Time is Now

- India is no longer just a promising future market; it is delivering results: in energy transition, manufacturing growth, and digital infrastructure. These trends are validated by government data and are being reinforced by incentive schemes and policy reforms.

- For institutional investors and multilateral bodies, partnering with India offers opportunity not only for economic return, but also for development impact: jobs, climate mitigation, sustainable infrastructure, inclusive growth.

- To capture the upside, investors should engage quickly, choose the right sectors and states, ensure strong project design (especially around regulatory, environmental, and partner risks), and align with India’s policy priorities (PLI sectors, clean energy, digital infrastructure).