Global oil prices surged more than 7% on Friday following a significant military escalation between Israel and Iran, raising alarm over potential supply disruptions in an already sensitive energy market.

By mid-morning trading in London, Brent crude futures soared $5.10, or 7.4%, to $74.46 per barrel, after touching an intraday high of $78.50. U.S. benchmark West Texas Intermediate (WTI) climbed by the same margin, reaching $73.15 per barrel, after peaking at $77.62. These movements mark the sharpest daily gains since early 2022, when Russia’s invasion of Ukraine rocked global oil markets.

The spike in crude prices follows Israel’s announcement of a large-scale military operation targeting Iran’s nuclear and missile infrastructure. Tehran acknowledged damage to its Natanz nuclear site but said there was no radioactive leak.

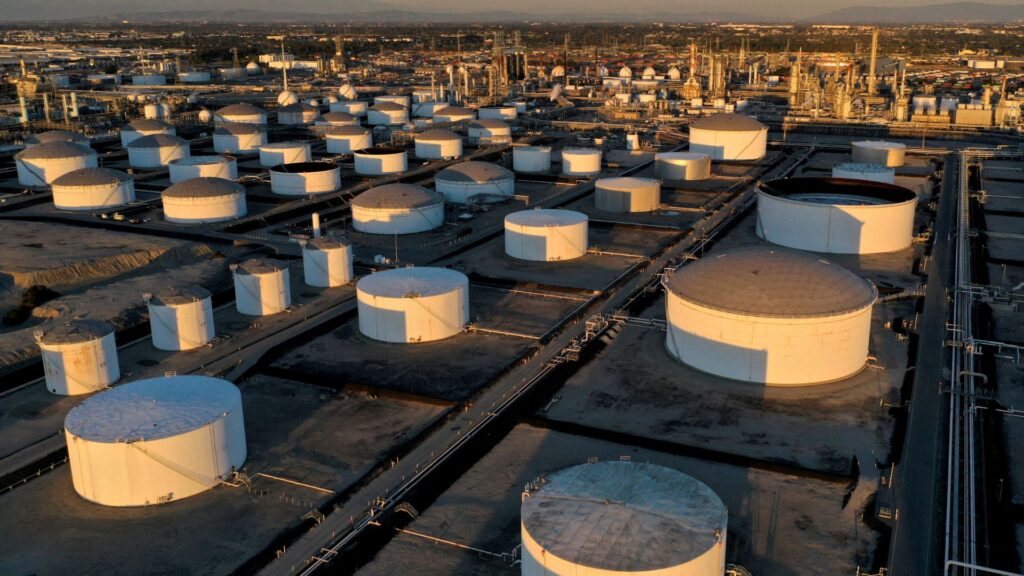

Oil traders and analysts are particularly concerned about the Strait of Hormuz, a vital corridor through which nearly 20% of global oil shipments pass. Though no immediate disruptions have been reported, the heightened risk of conflict in the region has injected volatility into energy markets.

“The potential for spillover is very real, even though oil flows remain unaffected for now,” said Ole Hvalbye, an energy analyst at SEB. “The market is on high alert.”

Investment banks issued fresh warnings over the situation’s implications. JP Morgan cautioned that if the strait were to be closed or key oil infrastructure targeted, crude prices could spike to $130 per barrel — nearly double current levels. Meanwhile, Barclays noted that although prices have surged, the market has yet to factor in any real decline in Iranian oil production, most of which is exported to China.

In a statement, U.S. Secretary of State Marco Rubio distanced the United States from Israel’s actions, describing them as unilateral and urging Iran to avoid retaliating against American personnel or interests in the region.

Despite the sharp price rise, analysts remain split on the sustainability of the rally. Much depends on whether hostilities escalate further or are contained. Some believe OPEC+’s spare production capacity could soften the blow of any supply shortfall, particularly if Iranian exports are disrupted.

Financial markets mirrored the geopolitical jitters, with global equities retreating and investors seeking refuge in traditional safe-haven assets like gold and the Swiss franc.

“The crucial question now is whether Iran chooses to keep its response limited to Israel or expands the scope of its retaliation,” said Helima Croft, head of global commodity strategy at RBC Capital Markets. “A broader conflict could significantly increase the economic and energy fallout.”

As the weekend approaches, oil prices remain elevated and market watchers are bracing for further developments in the Middle East.