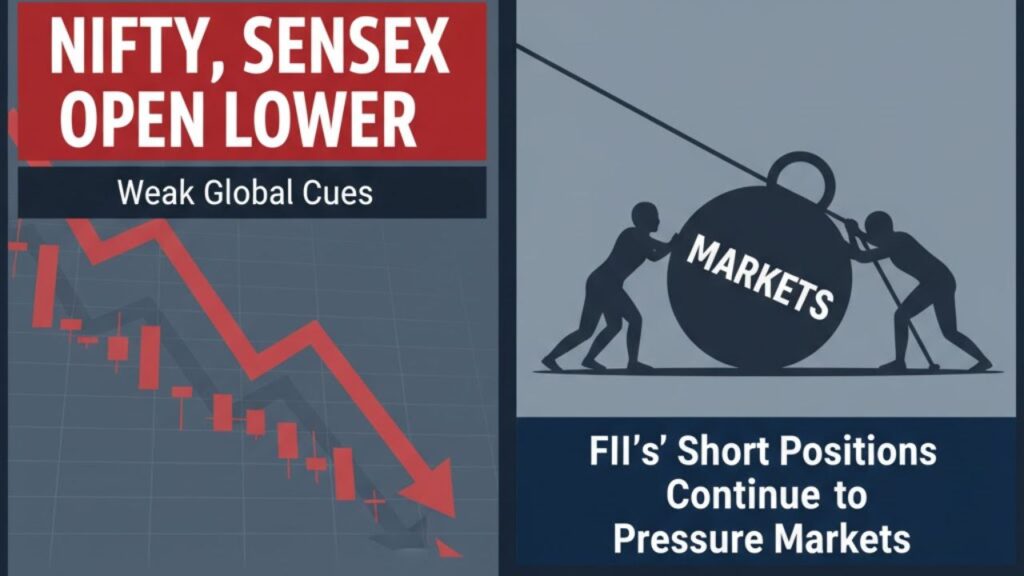

Indian equity benchmarks opened in the red on Friday, tracking weakness in global markets and continued foreign investor selling. The Nifty50 slipped below the 25,400 mark, while the BSE Sensex fell over 450 points in early trade.

At 9:19 AM, the Nifty50 was trading at 25,379.75, down 130 points (0.51%), and the Sensex stood at 82,855.57, lower by 455 points (0.55%).

Market experts suggest that the domestic market is currently in a consolidation phase with a mild downward bias. Analysts point out that a move above 25,700 on the Nifty could revive bullish momentum, whereas a drop below 25,500 may lead to further correction in the short term.

Dr. V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, highlighted that despite strong buying by domestic institutional investors (DIIs), the market continues to weaken. “On Thursday, DIIs bought equities worth ₹5,283 crore, whereas FIIs sold ₹3,263 crore. Yet, the market drifted lower as aggressive short positions by FIIs outweighed domestic buying. Their strategy of offloading Indian equities and reallocating to cheaper markets has proven effective so far,” he explained.

He added that while short covering could potentially trigger a rebound, there are currently no immediate catalysts to prompt such a reversal. “Markets, however, have a tendency to surprise investors,” he remarked.

Dr. Vijayakumar also noted that the ongoing correction presents an opportunity for investors to rebalance portfolios towards fairly valued large-cap stocks, particularly in sectors like banking and pharmaceuticals, which continue to show strong growth potential.

Across Asia, stock markets mirrored the downward trend following overnight losses in Wall Street. Investor sentiment weakened amid disappointing U.S. employment data and the Federal Reserve’s signal that interest rates may remain unchanged through the end of the year.

Concerns over overvalued technology shares added to the selling pressure, as this year’s strong rallies came under scrutiny. Additionally, a report from Challenger, Gray & Christmas revealed that U.S. job cut announcements hit a 22-year high last month, marking the sharpest wave of layoffs since the pandemic in 2020.

Back home, Foreign Portfolio Investors (FPIs) remained net sellers on Wednesday, offloading shares worth ₹3,263 crore, while Domestic Institutional Investors continued to lend support with net purchases of ₹5,284 crore.

With global uncertainty and sustained FII selling, Indian markets are expected to remain volatile in the near term.